SUU's Legacy Advisory Council Presents Free Tax Planning Seminar Series

Published: December 07, 2023 | Author: Clare-Estelle Perkins | Read Time: 2 minutes

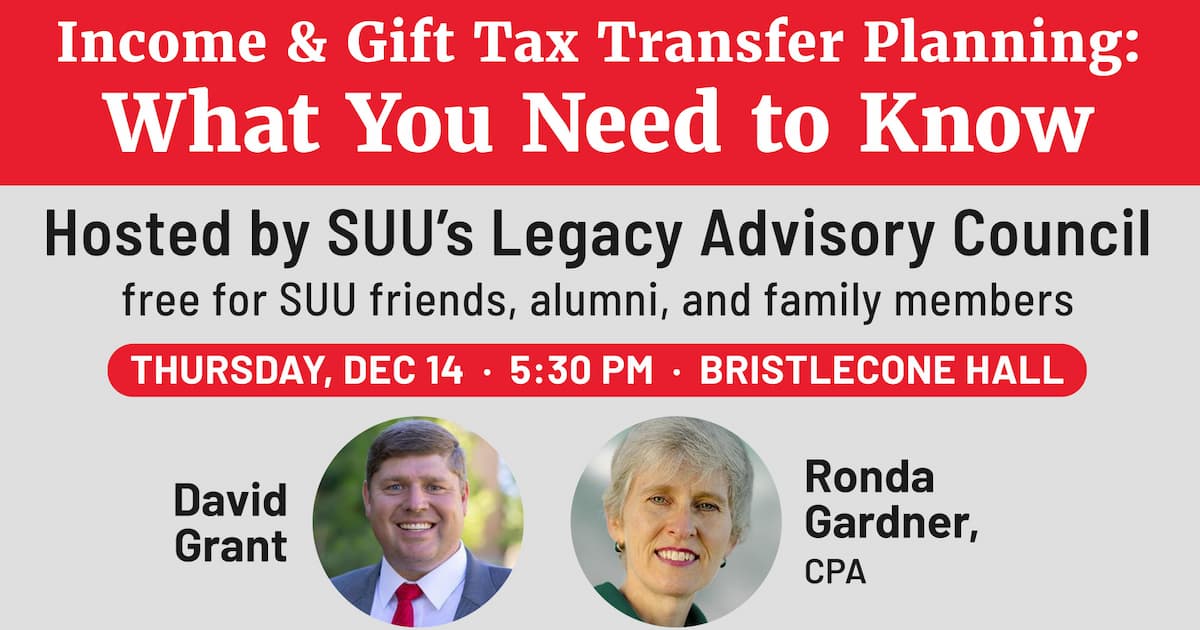

Join Southern Utah University's Legacy Advisory Council for an insightful and comprehensive seminar on Transfer Tax Planning Basics, where you can explore the intricacies of estate, gift, and generation-skipping transfer taxes. This seminar is designed to provide attendees and their clients with a clear understanding of the fundamentals of transfer tax planning, enabling them to make informed decisions to optimize their financial legacy and minimize tax liabilities.

The seminar will take place on Thursday, December 14th, 2023, from 5:30 PM to 6:30 PM in Bryce Room #121, Bristlecone Hall, SUU Campus (200 S 800 W, Cedar City, UT).

SUU's Legacy Advisory Council, in partnership with SUU's Advancement office, has launched a seminar series providing free estate planning and tax strategies for SUU friends, alumni, community and family members.

SUU's Legacy Advisory Council is a volunteer group whose primary goal is to assist donors and development staff in making long-term gifts to the university. Members of the Legacy Advisory Council can provide consultations in their respective areas of expertise, including charitable planning, family inheritance structures, improving financial and tax planning, and coping with other family challenges and dynamics.

The seminar will feature presentations by Ronda Gardner and David Grant. Ronda Gardner owns Gardner Estate & Trust CPA and has over 35 years of experience in accounting and taxation. David Grant maintains a legal practice at the law offices of Grant Morris Dodds, PLLC, where he is a founding member and where he handles the estate planning and business law needs for families in southern Utah and Southern Nevada. Grant is also an Assistant Professor of Accounting and Business Law at SUU.

Interested attendees can RSVP with Ryan Stringfellow at ryanstringfellow1@suu.edu or by phone at (435) 477-2501. Stringfellow can also provide more information about the SUU Legacy Advisory Council, or details about planned giving if you have named SUU as a beneficiary of your estate.

Tags: Advancement Alumni