What a College Student Budget Actually Looks Like

Posted: January 25, 2022 | Author: Kierstin Pitcher-Holloway | Read Time: 3 minutes

Starting a new budget can seem like a daunting task. Especially with all the expenses that come with being a college student. And while every student’s budget might look different, it can be beneficial to have a few examples to use as reference or inspiration while creating your own student budget.

Starting a new budget can seem like a daunting task. Especially with all the expenses that come with being a college student. And while every student’s budget might look different, it can be beneficial to have a few examples to use as reference or inspiration while creating your own student budget.

To help, we asked three different T-Birds with varying financial needs to share how they spend their money while in school. Remember, these are loose examples of how a few specific students have chosen to allot their income, your needs as a student and individual will vary.

Four Real College Student Budgets

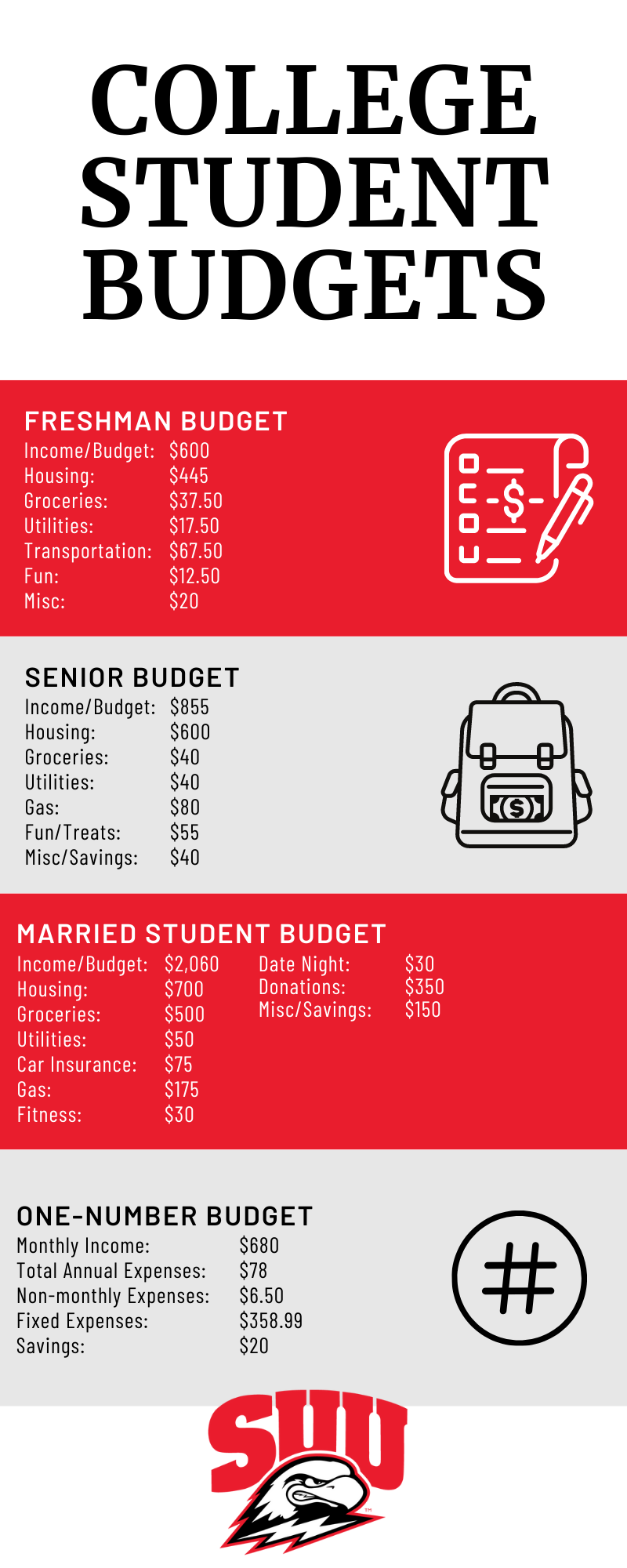

Freshman Budget

This budget is an example of a student who isn’t currently working while in school, but worked and saved throughout the summer to have money to live off of during the semester. Because of this, their budget is smaller and less flexible.

Income/Budget: $600

Housing: $445

Groceries: $37.50

Utilities: $17.50

Transportation: $67.50

Fun: $12.50

Misc: $20

Senior Budget

This T-Bird has a current job that they work while attending college. Because they aren’t living off of savings this budget varies more month to month, and has greater room for flexibility.

Income/Budget: $855

Housing: $600

Groceries:$40

Utilities: $40

Gas: $80

Fun/Treats: $55

Misc/Savings: $40

Married Student Budget

This is an example of a non-traditional student budget. These T-Birds are married and combine their income and expenses.

Budget: $2,060

Housing: $700

Groceries: $500

Utilities: $50

Car Insurance: $75

Gas: $175

Fitness: $30

Date Night: $30

Donations: $350

Misc/Savings: $150

The One-Number Budget

Another budget example that may be easier for college students to follow is the “One-Number” budget. This approach to budgeting is more flexible allowing increased freedom between variable expenses and only requires you to track one number as your spending guide.

To find your one number budget you must first calculate how much you spend on non-monthly expenses a year. This includes things like annual subscriptions or any quarterly payments/bills, registrations, fees, etc. Add up these costs and divide the total by 12 to find out how much you should set aside each month for these expenses; this is your “non-monthly expense number.”

Now you can calculate your one-number budget. To do this, start with your expected monthly income, and subtract all fixed costs for the month. This includes things like rent, subscriptions, monthly loan payments, etc. Then subtract your non-monthly expense number, and lastly subtract any monthly savings contributions from the total.

The number you are left with is how much money you have to spend on variable expenses every month. These are expenses that vary, like how much you spend on food, clothes, or entertainment.

If you would like a weekly spending budget then divide your monthly one-number by 4.3 (the average number of weeks in a month) and you’re left with a weekly one-number to follow.

One Number Student Budget Example:

Monthly Income: $680

Total Annual Expenses: $78

Non-monthly Expenses: $6.50

Fixed Expenses: $358.99

Savings: $20

Monthly One-Number Budget: $294.51

Weekly One-Number Budget: $68.49

Whatever models or examples you decide to use when creating your college student budget, know that budgeting is an ongoing process. It’s natural to experience a little trial and error, but following a budget during your college years will help you reach financial goals for years to come. For additional information or assistance setting up your student budget visit SUU’s Financial Wellness Center.

This article was published more than 3 years ago and might contain outdated information or broken links. As a result, its accuracy cannot be guaranteed.